by Michael Iverson

At one time or another, every business owner yearns to see how his or her company stacks up against the competition within the same industry. Comparing a company’s financial performance against that of its peers is likely to provide clues about how to improve the company’s results. For instance, it would be important to know whether a company’s administrative costs are significantly higher than those of others in the same industry.

Unfortunately, it’s not always easy to access competitive data. Competitive companies aren’t likely to publicly share financial results. Even if they do share some information, a large difference in size of a comparative company makes analysis difficult.

One way around the problem is to conduct the analysis using a Common-Size Income Statement, which converts a company’s income statement from dollars to percentages. Every line on the income statement is expressed as a percentage of Net Sales.

Using common-size income statements makes it possible to compare companies that are different in terms of size but in the same industry. While it might seem unlikely to compare two competitors with Net Sales of $4 million and $100 million respectively, focusing on percentages can bring relevance to the analysis. It also helps spot trends in your business, when comparing results to a prior period, for instance. You can address the issues before it’s too late.

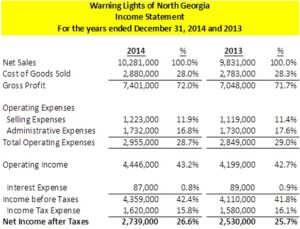

In the example below, Warning Lights of North Georgia’s income statement is shown alongside its common-size income statement. In the left-hand column are raw, dollar-denominated figures. The right-hand column shows the converted percentages. The percentages are based on a percentage of sales. In other words, you would divide the expense by the sales. For example, in the spreadsheet below, selling expense of 11.9% is determined by the following formula: 1,223,000/10,281,000= 11.9%.

Now, Warning Lights of North Georgia’s results can be compared – line by line if so desired – to those of any other company in the industry. (The financial statements of publicly-traded companies are accessible through the Securities and Exchange Commission’s EDGAR database or its Canadian equivalent SEDAR.) Industry averages are compiled by national trade associations and a handful of competitive intelligence information services. Banks, business brokers and good business libraries are likely sources of such information.

Using common-size financial statements, it is possible to determine how your company performs within its industry against the competition. Common-size income statements may be particularly useful in measuring the cost-effectiveness and profitability of a company against its peers as well as spotting trends when comparing multiple periods of your own financial results.