If a business owner had to manage by one single business metric, Gross Profit Margin (GPM) would be a solid choice. It provides a good look at the important relationship between a business’s Sales and its Cost of Goods Sold. Understanding this relationship is critical to business success.

The Calculation:

Gross Profit Margin = (Net Sales – Cost of Goods Sold) / Net Sales

(The calculation above uses numbers taken from an Income Statement. GPM is calculated as a ratio and is normally expressed as a percentage.)

Why is GPM an important metric to follow? Understanding your GPM is critical because it lets you as the owner know what it takes to be profitable after covering your other overhead costs that are not part of your Cost of Goods Sold in your GPM.

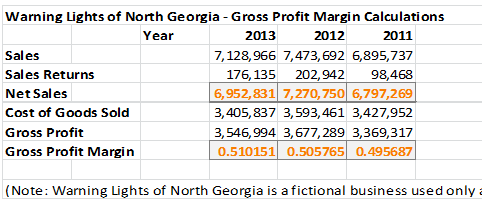

Below is an example of a company that focused on improving its GPM from year to year. For 2011, its GPM was 49.6 percent. For 2013, the number increased to 51.0 percent. In just two years, the company improved GPM markedly. Had the company’s GPM remained static from 2011 to 2013 at 49.6 percent, Gross Profit for 2013 would have been lower by more than $102,000 lower.

Although incremental improvement to GPM can be difficult to achieve, when accomplished it is truly a gift that keeps on giving. The $102,000 in higher profits (and cash flow) that Warning Lights of North Georgia achieved during the past two years should continue in future years. Improving GPM might come from finding new and lower cost sources of raw materials or re-engineering processes—without harming product quality.

Let’s do an example to illustrate the importance. If your GPM percent is 40% and your overhead costs that you need to cover each month regardless of whether you sell anything is $100,000, then how much business do you need to generate just to breakeven for the month?

If you don’t know the answer to this question, it could mean the difference between losing money or making money. In our example above, it would require the business to generate $250,000 in revenue to cover its overhead costs. How did we come to this conclusion? Using the following formula:

- $100,000 overhead cost / 40% = $250,000

Keep a close eye on your GPM because it can make the difference between operating at a profit or at a loss.

Here are some Numbers Coach tools to help you calculate your GPM: