Bankers who lend to small businesses in manufacturing and distribution often calculate a client’s inventory turnover ratio. “What are the bankers looking for in a ratio?” clients sometimes ask.

First, bankers wonder whether the business is carrying inventory that is disproportionate to its sales. Carrying excess inventory is not a productive use of capital when money is tied up in product that sits on a shelf and incurs warehouse costs.

A second concern for lenders is that inventory not turned over quickly will become obsolete, damaged, or outdated. In any of those circumstances, revaluation of the inventory is necessary and losses must be booked. That’s a concern to lenders. Also a decreasing turnover rate could indicate a slowing sales and lower profit trend.

Calculating the Ratio

The ratio is only difficult to calculate if a business’s inventory varies significantly throughout the year. Inventory Turnover is calculated as Cost of Goods Sold divided by Average Inventory. The Cost of Goods Sold is always calculated for the Income Statement, so the figure is readily available. Average Inventory may be trickier. For businesses with fairly constant inventory levels, simply add Beginning Inventory to Ending Inventory and divide by two to calculate a simple average.

This simple average doesn’t always work well, however, because many businesses have significantly less inventory at the beginning and end of the year than at other times. The simple average, therefore, uses an artificially low denominator, which tends to overstate the Inventory Turnover Ratio. So, if monthly inventory figures are available to calculate the average their use will provide a truer Inventory Turnover Ratio:

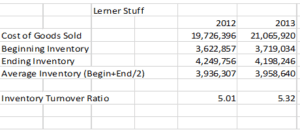

Using information from the table above, we can calculate Lerner’s Inventory Turnover Ratio for 2012 and 2013. The ratio is determined by dividing Cost of Goods Sold by Average Inventory for each year. For 2012, the calculation is 19,726,396/3,936,307=5.01. For both 2012 and 2013, Lerner turned over its inventory slightly more than five times per year. Bankers interested in Lerner’s Inventory Turnover Ratio would likely compare the Lerner ratio against those of other companies in the same industry. A turnover ratio significantly below those of Lerner’s peer group might cause bankers concern about inventory obsolescence.

Let us know if you would like to see how your ratio stacks up against those of your peers, or to discuss how to improve your ratio.