Description

Worried about running out of cash in your business? Get the tools that you need to measure and analyze your company’s working capital requirement. Monitoring your business’s working capital requirement can mean the difference between having cash or not having cash to operate your business on a day-t0-day basis.

This easy to use and cost-effective tool kit includes the following:

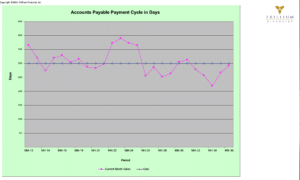

- Accounts Payable DPO: This calculator helps you determine how many days its takes for your business to pay its bills: The longer the days, the more cash you retain

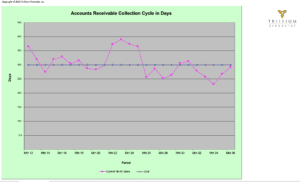

- Accounts Receivable DSO: This calculator helps you determine how many days it takes for your business to collect from your customers: The fewer the days, the quicker you get paid

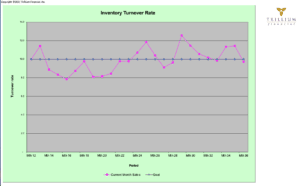

- Inventory Turnover Rate: This calculator helps you determine how quickly your business turns over its inventory: The higher the rate, the quicker inventory turns and the less cash is tied up in inventory

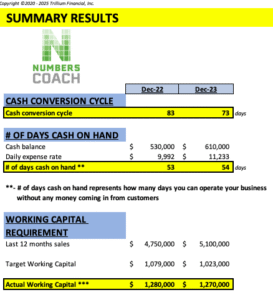

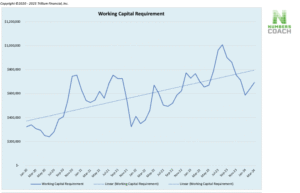

- Working Capital Requirement Calculator: This calculator helps you determine what amount of working capital you need to maintain in order to operate the business on a day-to-day basis without feeling stretched for money to pay your bills.

- Working Capital Trends: This template helps you track metrics associated with your working capital requirement to provide visibility on positive or negative trends.

Don’t be in the dark when it comes to knowing how much cash you need to run your business! Invest in the Working Capital Tool Kit today.